Understanding Meme Coins

Meme coins have grabbed the spotlight in the crypto scene, catching the eye of investors and thrill-seekers alike. Let’s break down what makes these quirky digital assets tick and the risks that come with them.

What Makes Meme Coins Tick?

Meme coins like DOGE, SHIB, and PEPE stand out in the crypto crowd for a few reasons:

- Community Power: Meme coins thrive on community buzz and online trends. Platforms like Twitter and Reddit are their playgrounds, where a single post can send prices soaring or crashing.

- No Real-World Use: Unlike other cryptos that solve problems or offer services, meme coins often don’t have any real-world use. Their value is mostly driven by speculation and hype.

- Wild Price Swings: These coins are notorious for their roller-coaster prices. One minute they’re up, the next they’re down, thanks to speculative trading and social media chatter.

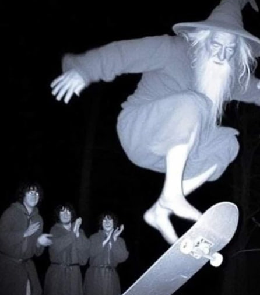

- Celebrity Influence: Big names can make or break meme coins. A tweet from someone like Elon Musk can send prices through the roof or into the basement.

The Risks of Meme Coins

Investing in meme coins can be a wild ride with big rewards but also big risks. Here’s what you need to watch out for:

- Market Games: Meme coins are prime targets for ‘pump-and-dump’ schemes, where prices are artificially inflated and then suddenly dropped, leaving latecomers in the dust.

- Crazy Fluctuations: Their prices can change in the blink of an eye, making it tough to predict where they’ll go next.

- No Real Value: Without any real-world use or intrinsic value, meme coins’ prices can plummet just as fast as they rise.

- Too Many Coins: Many meme coins have a huge or unlimited supply, which can dilute their value and add to the price chaos.

| Risk Factor | Description |

|---|---|

| Market Games | Prone to ‘pump-and-dump’ schemes |

| Crazy Fluctuations | Prices swing wildly due to community buzz and speculative trading |

| No Real Value | Lacks intrinsic value or long-term utility |

| Too Many Coins | Large or unlimited supply dilutes value |

Before jumping into meme coins, weigh these risks carefully. For more insights, check out our articles on meme coins with utility and meme coins price prediction.

Community Dynamics

How Communities Shape Meme Coins

Memecoin communities are a riot of fun and humor, keeping things light and lively. This playful vibe draws people in, making them want to join in on the jokes and discussions. It’s a stark contrast to the often serious tone of traditional crypto groups. The shared laughs and memes create a tight-knit group that’s always buzzing with activity.

These communities thrive on platforms like Discord and Telegram, where members chat, share memes, and rally around their favorite coins. This constant chatter is crucial for spreading news quickly, drumming up support for new launches, and keeping the hype alive. When everyone’s in on the joke, it’s easier to keep the momentum going.

Sometimes, these groups even plan buy-ins at specific times, causing trading volumes to spike. Whether it’s a celebration or a response to some outside criticism, these coordinated efforts can really shake things up, affecting the coin’s price in a big way.

Social Media’s Role in Meme Coin Prices

Social media is a powerhouse when it comes to meme coin prices. These coins often ride the wave of viral trends, catchy memes, and shout-outs from celebrities. Take Dogecoin, for example. When Elon Musk or Mark Cuban tweets about it, the price usually shoots up. This shows just how much investor sentiment and social media buzz can drive the value of these coins.

Here’s a quick rundown of what influences meme coin prices:

| Factor | What It Means |

|---|---|

| Going Viral | Memes spread like wildfire, boosting popularity and prices. |

| Fun Factor | The humor keeps people interested and attracts new investors. |

| Celebrity Shout-Outs | Big names can send prices soaring with a single tweet. |

| Trending Topics | Platforms like Twitter and Reddit can make or break prices. |

| Community Power | Active groups can cause price swings with their coordinated actions. |

Want to know more about how social media impacts meme coin prices? Check out our article on meme coins price volatility.

Understanding how communities and social media shape meme coins can help you navigate this wild market. Whether you’re joining meme coins Discord communities or tracking meme coins Twitter mentions, staying in the loop is key to making the most of your investments.

Trading Strategies

Risk Management in Meme Coin Investments

Trading meme coins can be a wild ride—big rewards, but also big risks. To keep your losses in check and your gains on point, you need some solid risk management strategies. Here’s how to play it smart:

- Spread Your Bets: Don’t throw all your money into one meme coin. Spread your investments across different assets to avoid putting all your eggs in one basket.

- Stop-Loss Orders: Set stop-loss orders to automatically sell your coins if their price drops to a certain level. This can save you from catastrophic losses.

- Small Stakes: Only put a small chunk of your portfolio into meme coins. They’re super volatile, so it’s wise to limit how much you risk.

- Do Your Homework: Research the meme coin projects thoroughly before investing. Check out our detailed guide on meme coins fundamental analysis for more insights.

- Stay in the Loop: Keep an eye on market trends and social media buzz. Join meme coins telegram groups and meme coins discord communities to stay updated on community sentiment.

Factors Influencing Meme Coin Prices

Meme coin prices can swing wildly, influenced by a mix of factors. Knowing what drives these changes can help you craft better trading strategies.

-

Social Media Hype: Platforms like Twitter, Reddit, and Telegram can send meme coin prices soaring. Celebrities and influencers can cause huge price spikes. For example, a tweet from Elon Musk once boosted Dogecoin’s price by 135% in just four days. Dive deeper into this in our article on meme coins twitter mentions.

-

Speculative Trading: Many folks buy meme coins hoping to sell them at a higher price later. This speculative trading can lead to sharp price jumps and drops.

-

Market Manipulation: Meme coins are often targets for ‘pump-and-dump’ schemes, where prices are artificially inflated and then suddenly dropped, causing big losses for investors (CoinJar). Learn more in our piece on meme coins price volatility.

-

Lack of Real Value: Unlike traditional cryptocurrencies, meme coins often don’t have intrinsic value or utility. Their prices are mainly driven by market sentiment and community interest (CoinJar). Find out more in our guide on meme coins with utility.

-

Supply and Demand: Many meme coins have a large or unlimited supply, which can affect their prices. Understanding the meme coins total supply and circulating supply is key for making smart investment choices.

-

Investor Psychology: Emotions like Fear of Missing Out (FOMO) and Herd Mentality play a big role. Influencers and celebrities can easily sway investor decisions, leading to exaggerated price swings.

| Influencing Factor | Impact on Price |

|---|---|

| Social Media Hype | High |

| Speculative Trading | High |

| Market Manipulation | High |

| Lack of Real Value | High |

| Supply and Demand | Medium |

| Investor Psychology | High |

Understanding these factors can help you navigate the rollercoaster of meme coin trading more effectively. Stay informed and make data-driven decisions to boost your gains. For more tips and strategies, check out our article on meme coins investment tips.

Investor Tips

Dipping your toes into meme coins can be a wild ride, full of ups and downs. Here’s some advice to help you make smart choices and hopefully come out ahead.

Smart Moves for Meme Coin Investors

Jumping into meme coins isn’t for the faint-hearted. Here’s what you need to keep in mind:

-

Only Bet What You Can Afford to Lose: Meme coins often don’t have real value or practical use. They mostly ride on community buzz and speculative trading (CoinJar). Stick to investing an amount you’re okay with losing. A good rule of thumb is to keep your crypto investments under 5% of your total portfolio.

-

Keep Your Cool: Emotional investing can lead to rash decisions and bigger losses (CoinJar). Stay calm and avoid making moves based on hype or panic.

-

Watch Out for Pump-and-Dump: Some folks pump up the coin’s price and then dump their holdings, causing the price to crash. Be wary of sudden price jumps.

-

Know the Liquidity Risks: Low-liquidity tokens can be easily manipulated due to low trading activity. This can lead to big losses if you’re not careful.

Do Your Homework

Before diving into meme coins, a little homework can go a long way. Here’s what to look into:

-

Check Out the Team and Transparency: Meme coins often have sketchy details about their teams and goals (CoinJar). It’s tough but important to gauge the project’s credibility.

-

Look at Market Demand and Tech: Understand the tech behind the coin and see if there’s any real demand for it. This means checking out its use case and potential adoption.

-

Be Skeptical of Social Media Hype: Meme coins are often driven by social media trends and celebrity shoutouts. While these can boost prices short-term, they also bring a lot of volatility.

-

Stay Alert to Market Manipulation: Meme coins usually lack regulation, making them ripe for price manipulation and other shady activities. Knowing these risks can help you make smarter choices.

| Risk Factor | What It Means |

|---|---|

| No Real Value | Meme coins rely on community buzz and speculative trading. |

| Emotional Investing | Leads to rash decisions and bigger losses. |

| Pump-and-Dump | Price gets pumped up and then crashes when big holders sell. |

| Liquidity Risks | Low trading activity makes them easy to manipulate. |

By following these tips and doing your research, you can better handle the rollercoaster that is meme coins. Stay informed and base your decisions on data, not emotions or hype. For more tips, check out our articles on best meme coins to invest in and meme coins with utility.